Table of Contents

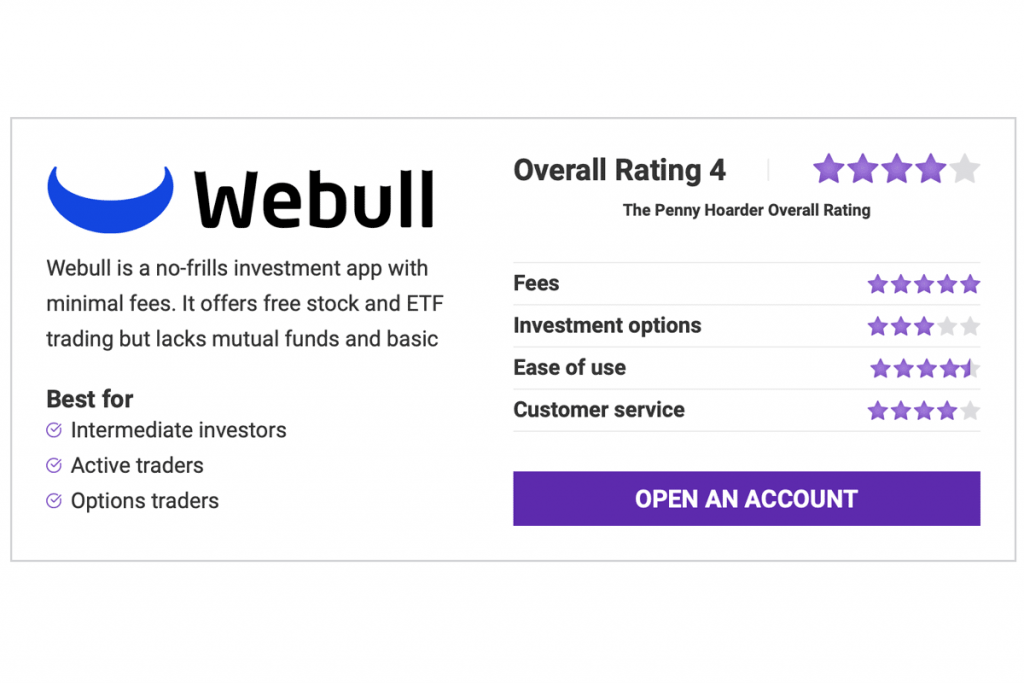

- Webull Review 2022: Pros and Cons

- Webull Pay: Crypto Buy & Sell - Apps on Google Play

- Webull Singapore 11.11 Promotion – USD150 Cash Voucher for the Month of ...

- Webull Review: Should you Consider Webull in 2023? - Tasty Referrals

- Webull May 2023 New Offer – Get Upto 12 Free Stocks + Earn a 5.8% APY ...

- Webull Singapore Review – Free US Stock, Options and ETF trading + Sign ...

- Tracking Pricing With Webull for Better Fills : r/Webull

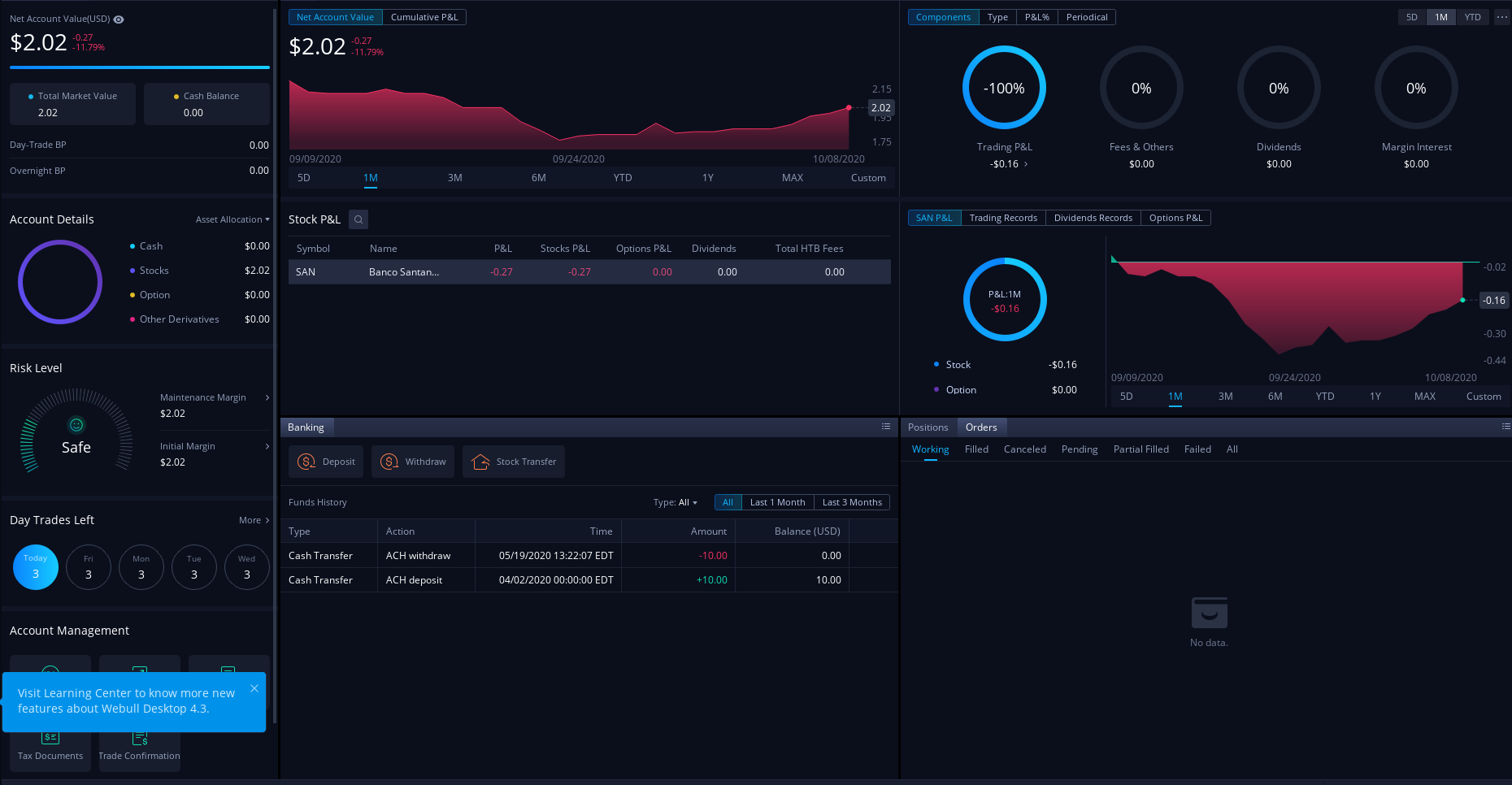

- Do Most Growth Stocks Pay Dividends Webull Desktop Review – The Waverly ...

- GameStop turns little-known China firm Webull into No. 2 app in US | KrASIA

- Webull Promotion and How to Open a Webull Account – Mathtuition88

Webull, known for its commission-free trading platform and user-friendly interface, has been gaining traction among retail investors. The company's merger with a SPAC has not only provided it with the necessary funding to expand its operations but has also given it a public listing, making its stock more accessible to a broader range of investors. This development aligns with the current trend of fintech companies opting for SPAC mergers as a faster route to going public, compared to traditional initial public offerings (IPOs).

Understanding the Surge

- Increased Visibility and Accessibility: The SPAC merger has brought Webull into the spotlight, making it more visible to potential investors who might not have considered investing in a privately held company. This increased visibility, combined with its public listing, has made its stock more attractive.

- Growth Potential: Webull operates in the fintech sector, which is known for its rapid growth and innovation. Investors are betting on Webull's potential to expand its user base, introduce new financial products, and capitalize on the trend of digital trading.

- Funding for Expansion: The capital raised from the SPAC merger will likely be used to enhance Webull's platform, improve its services, and possibly explore new markets. This potential for expansion has excited investors, leading to the significant surge in stock price.

Implications for the Fintech Industry

The fintech sector has been attracting significant investment in recent years, with companies leveraging technology to provide innovative financial services. Webull's success story serves as a testament to the potential for growth and the appetite of investors for fintech stocks. It may encourage more fintech companies to consider the SPAC route for going public, potentially leading to a flurry of new listings in the sector.

With its user-friendly platform and commission-free trading, Webull has positioned itself as a leader in the online brokerage space. The company's future plans, including potential expansions into new markets and the introduction of new products, will be closely watched by investors and industry analysts. As the fintech landscape continues to evolve, companies like Webull are at the forefront, pushing the boundaries of what is possible in digital finance.

Investors interested in the fintech sector would do well to keep an eye on Webull and other companies in the space, as they continue to innovate and grow. The potential for substantial returns, as seen in Webull's recent stock surge, makes the fintech industry an exciting and potentially lucrative area for investment.